Moreover, I would like to ask @0xchop if the current $NFTX and $FLOOR teams have any vested interests with Merit Circle, $BEAM? i.e. token vests, reward streams, investment etc in the past or in the foreseeable future.

I think its relevant to the discussion and people deserve to know this information.

Speaking for everyone on the NFTX & FloorDAO team here, I can confirm that none of us have been rewarded by Merit Circle in the form of token vests, reward streams or otherwise, nor are there agreements in place for us to get rewarded in such a manner in the future. For open market trading, whatever any of the current team members do with their personal funds, now or in the future, is neither my business nor something that should be disclosed on a public forum.

Merit Circle receives ~$2.5M of equity & treasury value. That’s it. Basically, you are asking tokenholders to hand over assets and have the nerve to tell them to “sell if they are not happy” while you acquire ~$2.5M worth of liquid assets for $0.

Our proposed token allocation would not be liquid, but subject to attractive vesting terms for existing token holders. I can see why, from your perspective, it may look like MC/Beam are getting an allocation in New Token without contributing something in return. However, as stated in my previous response to you, behind the scenes MC/Beam has already devoted significant resources from multiple members of its team (and, if the proposal passes, we intend to devote considerably more) to develop the concept of Project New Wind. These team members are also valuable contributors to our other projects, but we’ve chosen to redirect their efforts to Project New Wind for the past few months and are committed to doing so well into the future.

I’m sorry but no. If Merit Circle thought both teams had more value than the market currently prices them at, Merit Circle would be able to take a substantial stake in both DAOs at an acquisition price way below book value, with a reduced risk thanks to the assets held by each treasury. If you are not doing it, it probably means you have close to no confidence it is the case.

MC/Beam’s aim here is not to be a passive holder of Project New Wind, but rather to collaborate with the NFTX and FloorDAO teams to both enhance and scale the current state of each project. By receiving a token allocation subject to the amended vesting terms instead of simply investing in NFTX and/or FLOOR, MC/Beam’s incentives to grow Project New Wind are significantly more aligned with those of the NFTX/FloorDAO teams and the token holders.

Others have tried to use deceiving pie charts and “foundation tokens” to hide embezzlement done in plain sight, and I have been around long enough to know that “30% to treasury” to finance long-term growth basically means 100% of it will go to team members and contributors, certainly not to DAO token holders. So yes, these new tokenomics still mean every token holder is sacrificing 50% of its backing in this merger.

To clarify, 20% of New Token’s supply will be in direct control of the token holders via on-chain governance. If the token holders disagree with how these tokens should be distributed (e.g., to team members and contributors, as you state) then they have the ability to actually block their spend via smart contract. There won’t be a method for the team or contributors to circumnavigate this right for token holders. The other 10% will be held by the Foundation subject to oversight from the mandated Supervisor.

I don’t want to be pictured as someone who doesn’t support a strong move forward to increase NFTX’s odds of finding product-market fit and growing valuable products. But there needs to be a balance between what the upside/downside looks like for every counterparty in this deal. It can’t be “team/MC gets 100% of the upside and 0% of the downside while current tokenholders get 50% of the upside and 100% of the downside potential”.

Again, MC/Beam has expended, and will continue to expend, significant resources in the form of FTEs (and, in some cases direct, funding of costs) from its internal team on the development of Project New Wind. These resources could be reallocated to other projects in MC/Beam’s stable, however we see real potential in Project New Wind and have therefore made the decision to risk both time and these resources in an effort to see Project New Wind succeed.

Moreover, MC/Beam is bringing a lot of intangible value to the table, through its network, expertise and distribution/reach. We believe we can unlock more value for the project than any contributor would with the same incentive package or versus burning the tokens.

A combination of 1) opt-in/opt-out + 2) options for team members and MC is the most sensible way to make this deal more balanced for everyone. It aligns interests, provides a safety net for token holders that at the end of the day still hold the treasury, and makes sure resources are allocated to value creation from day 1. All parties are incentivized to build and support strong value-creation projects.

See the amended terms of the proposal with respect to the team allocation of New Token, including for MC/Beam.

Merit Circle should put some skin in the game, the idea of options is one of the most commonly used for technical/professional involvements in a project, to guarantee alignment, even with market makers.

Alternatively, Merit Circle professional services should be evaluated at their normal cost, without equity dilution.MC/Beam’s aim here is not to be a service provider to Project New Wind, but rather to collaborate with the NFTX and FloorDAO teams to both enhance and scale the current state of each project. By receiving a token allocation subject to the amended vesting terms instead of a cash payment, MC/Beam’s incentives to grow Project New Wind are properly aligned with NFTX/FloorDAO teams and the token holders.

See also the amended terms of the proposal with respect to the team allocation of New Token, including for MC/Beam. This is an amendment we’re more than willing to make to add an extra layer of trust into the fact that the entire proposal is written in good intent and as a way to grow Project New Wind, while it also being an answer to current dilution concerns from the team allocations’ perspective.

Thank you for taking feedback here and for the updated proposal. This is a step in the right direction.

The updated proposal makes vested team tokens non-transferable unless the FDV of New Token reaches or exceeds 75 million, and are immediately transferrable thereafter.

I see two issues with this:

- The treasury has a high beta with ETH price. If the ETH price increases dramatically, 75m FDV could be hit with the team not lifting a finger. Yes, the ETH price could also drop dramatically, but in effect the team is receiving a free option on ETH, which has value (worth 0 if price drops, worth 6m+ if price increases). The solution to this is to use backing rather than a fixed value.

- There is price manipulation risk, where the team could maliciously remove liquidity, make a small buy in a low-liquidity market to increase FDV, and then transfer their tokens, without actually achieving the intended FDV.

This can happen maliciously, or just unintentionally, like here when the FLOOR price was 500 ETH for a few minutes: Ethereum Transaction Hash (Txhash) Details | Etherscan

–

Using a solution with stock options with strike price at backing would address these, as it would force team members to buy their tokens at backing, which they would not be able to profit from if they could not sell into the liquidity at profit. Furthermore, it guarantees no dilution of treasury for tokenholders, as new tokens are only minted if the backing equivalent goes into the treasury.I also echo @dcfgod that initial tokenomics should not include the 30% for treasury. There are use cases for treasury tokens, but these can be minted on an as-need basis via community vote.

Looks like we’re making some great progress

- Awesome update from the team and glad to see more alignment with reaching backing value. I assume the 75M number is because the combined treasuries are 30M and holders get 50% of the supply so it’s a 25% higher than if we reached 1x book value today.

- Agree with bino on the above, instead of 75M just make it like 1x book value by not minting 30% for the treasury, and considering team supply as options instead of circ tokens. That way the new project launches with 0 new dilution and backing value is easily calculated and even maintained as team tokens become circulating.

- This change certainly makes me more comfortable and willing to vote yes. Although I would still be a no because although we’ve now fixed one issue, we haven’t fixed some of the bigger ones. Could the team please also amend the proposal to solve these remaining problems:

- Be clear that the backing still exists in new wind. The legal changes and Gaus’ statements in nftx discord allude to holders completely losing their worst case outcome of 1x treasury value. The setup should be “worst case book value, best case multiples of it”, not “worst case 0, team success 1x book value, best case multiples of it”.

- If things don’t go as well as expected, have a backup plan. Right now we are being asked to risk it all on a merger and trust us bro scenario. If new buyers don’t show up and we can’t get to multiples of book in a decent timeline what do we do? For example something like “We agree that within 6 months new wind token will be trading. We will spend a maximum of $xx. If at no point it trades above 1x book value on a 2 week twap we will open a 1 time rage quit so everyone in floor and nftx will at worst get a 2-3x from here (assuming eth and nft values stay the same)”. This type of solution would let the team use the treasury as needed to make new wind work, give holders peace that they aren’t going to get a 0, and allow the merger to happen.

- Give us much more details on how this is going to look. Is the L2 sophon? will sophon be giving us incentives? How does flayer even work? How will we now use the protocol owned liquidity? What happens with nftx v3, is it done or do we care to launch it elsewhere? How does liquidity look for the new token? When does the new token launch? How does it earn revenues? What is needed so the revenues are enough to hold up the prices on a $30M treasury?

would also like to re iterate to plz stop telling people to sell on the AMM if they don’t like this. Both FLOOR and NFTX have been through their fair share of selling, the people here still holding were not willing to sell last week, this proposal shouldn’t make them want to sell now that it exists. They should be left exclusively better off for staying and trusting the teams for this long.

TheRealMarx, a liquidation plan where the treasury is returned to the token holders is effectively an expression of the opinion that token holders don’t believe we can accomplish something better than the present value of the treasury

Yeah you’ve parroted this five times already doesn’t make it any more erudite or true.

Holders have the right to believe the team can’t deliver because:

- NFTX has lost in real terms to inflation and btc/eth and usd values since inception. The token has performed horrifically.

- NFTFi is effectively a dead and shrinking TAM. Floor and NFTx are a vehicle for siphoning funds right now effectively. Floor less so since they’ve cleanly satisfied all responsibilities to token and DAO members

- Given the above two facts I think you’ll agree that holders have the right to a little better than a lazy “go sell on a dex then if you don’t like it” answer - especially since this tired line of thinking has been proven out to be not the optimal way forward again (Floor) and again (Nexus Mutual).

Thinking about this some more

Can we also get some info on why the treasury is absolutely necessary for new wind to be a success?

Like could we not launch flayer and do this without also owning $30M of punks, milady, eth, etc.

And if we can’t do it without the treasury, then why do we think the product can ever be successful?

Would it be possible with just like $1-2M of stables runway to last at least 1 year of efforts?

If so, we could do something extremely bullish for the holders of both floor and nftx

Lively discussion!

Interesting takes on both sides.

Blockquote * Awesome update from the team and glad to see more alignment with reaching backing value. I assume the 75M number is because the combined treasuries are 30M and holders get 50% of the supply so it’s a 25% higher than if we reached 1x book value today.

By my maths it’s 5x (500% of) the current combined fully diluted marketcap of the projects and 2,5x (250% of) the current treasury value.

Treasury value 30Mish

FDV 15MishHow do you arrive at your calculation? Did you remove native tokens?

I agree that generally an even higher hurdle could be better, at the same time, it’s more than 99% of other crypto teams handicap themselves with. Who usually only have a vesting schedule (that is generally shorter). Also, at what point do extreme hurdles become a disincentive to contributors?

If the team is good and true to their vision, they will pay with their blood sweat and tears, if they are not, that’s the risk you would have in any project you invest in. End of the day, you have to trust the contributors or move on. At least this shows they have a strong conviction that the project could be valued much higher than it is today.

While a ragequit on a high level might seem fair and attractive in theory, I see three big problems with the ragequit option. (Aside from potential legal risks which I assume are myriad, but I am not qualified to comment on)

1. Not in best interest of project in long-term and of average tokenholder

Any direct redemption from the treasury is long-term value destructive to all other tokenholders that want to optimize for long-term treasury value. The average tokenholder that holds for the longerterm would be much better of compounding a positive growth rate from a 30MM treasury versus, say for example, a 15MM treasury. This is also why startups or growth companies would never introduce mechanisms like it, it would be unfair to the average shareholder and hurt the long-term value potential.It’s clear why it’s attractive to people who bought the token below treasury value with the sole goal of realizing the delta between treasury value as soon as possible, at any cost. However, this is only a subset of (I suspect vocal) people. There are a lot of people that want to see this project thrive in the long-term and want to realize a higher tokenvalue. Either because they had a different entry level, or because they have a longer time horizon, or stronger conviction in the vision (or a combination).

Ultimately it comes down to, do we believe something of value can be built here.

2 Liquidity is part of the product attractiveness

Unlike most treasuries, here the treasury actually serves a product function in the form of liquidity. Removing liquidity will not just reduce the base the treasury can compound from, but in fact could lower the quality of the product and by extension the future revenue potential of the DAO.3. Ragequits are tricky - the treasury is illiquid

Adding a ragequit mechanism would severely impact actual realized values of combined treasuries of both NFTX and FloorDAO. Coordinated ragequits on such size, for a small selection of NFTs, after removing POL as both FloorDAO and NFTX, will have a detrimental effect on the floor value of holdings and might impact true value of the treasury much more severe than you’d like it to be (theoretical book value based on spot pricing is something completely different than liquidating distressed assets.To add to this, it’s a very hairy process to begin with as to come to the true fair value, you have to sell everything unless the ones that do not ragequit agree with which assets are and are not sold. Optimistically the ones that stay choose to keep the treasury balanced in the way it is, but given the price impact on certain collections (the ones you hold a lot of, or don’t have any liquidity like the AutoGlyphs from NFTX) that’s not a realistic scenario you can expect remaining token holders that choose to not rage quit to agree with.

You would take an illiquidity discount on every sale, and then would be further discounted by putting pressure on the floor value.

I think it’s easier with certain treasuries, but even for more liquid treasuries you can see how often it has led to arbitrary unfairness (mechanism, timing, period) between groups and how generally, it has always been value destructive to projects as a whole (average tokenholders). Usually it means the end of a project. It sounds fair and easy in theory, but in practice I have rarely seen it work well yet and I suspect for the above reasons thats even more so the case here.

Thats not generally how its calculated. Generally one would take the whole supply to derive a calculation.

The other 50% of tokens could be used value accretive by the DAO, and then you could assume a lower base valuation than 30MM even. That would be a similarly strange base assumption.

If your argument is there shouldn’t be any DAO (controlled by all tokenholders - to be used value accretive) or contributor tokens then I am not sure why you have bought into this project to begin with. This is not an investment fund.

Totally agree with most of your points here on a rage quit not being the most attractive option for reasons named above. Also I don’t think most people (also the vocal ones that bought below treasury value) actually want the treasury to dissolve. Let’s be clear for everyone the optimal outcome is for the product to be a success.

Speaking about average tokenholders, the people talking here are the average (and only) tokenholders that are not team or team affiliate. From the perspective of the average tokenholder the past few years have been quite slow and painful with little traction. The reason for this could be team not executing/pivoting well or could just be a slow NFT market. I see the huge competitive advantage both NFTX and FLOOR have compared to other or new nftfi projects due to the liquidity they are able to offer on for example PUNKS. The harsh reality is that the average tokenholder is currently only here exactly because of that The treasury both for the options it offers from a product perspective but also the safety it offers in case the product or team might continue failing to deliver.

Now we are told time in time out again:

TheRealMarx, a liquidation plan where the treasury is returned to the token holders is effectively an expression of the opinion that token holders don’t believe we can accomplish something better than the present value of the treasury

And yes that is exactly what we are saying: We are not sure the team can accomplish something better than treasury value because that has not been the case the past year(s). Why should we expect it to change all of a sudden? Now we are asked to give up our entire claim on the treasury under Project New Wind and ridiculed for not being moonbois and believing. I would like our safety net to remain. As said before your average tokenholder is asked to take all the risk with New Token and has to give away a part of their upside due to dilution on a trust me bro basis. This is not acceptible for your average tokenholder.

Point being most of us don’t want to force a rage quit. Only if the terms offered are not fair and largely skewed towards MC and team this is what the average tokenholder wants. I am willing to invest and willing to see if we can accomplish sth better than treasury value together but not on a dive-in head first basis.

It would be great to first fund project New Wind with opex for a predetermined period and only after we see some substance discuss committing the entire treasury to it. In combination with proposed option structure this would shift risks to a more balanced equilibrium between all stakeholders in my opinion.

It’s very easy to keep holding this DAO tokens and contributor tokens are value accretive oasis in front of everyone’s eyes. However, where is the proof? What value was created for tokenholders over the past years?

Joined 1 day ago. Curious.

Not in best interest of project in long-term and of average tokenholder

Rage quit with a tax improves each stayooors book value claim on the treasury - thereby rewarding further for believing in the team and this rushed merger agreement. If you’re salty about people arbing the dex <> backed price I suggest you start buying as well.

Debunked.2 Liquidity is part of the product attractiveness

Ok so why doesn’t Merit Circle put in actual hard dollars then for their stake? Liqudiity and capital matters a lot here right? We’re giving ownership away for a bunch of behind the scenes intangibles which we can’t assess as token holders until it’s too late… clear cognitive dissonance here.

Also, it’s a $20m+ treasury not $3m, have you looked at the latest blur or NFTX volumes? Objectively, this is poor capital use. When a corporation has excess capital and not enough NPV positive projects it gives the capital back to token holders. Literally corporate finance 101. Debunked

Adding a ragequit mechanism would severely impact actual realized values of combined treasuries of both NFTX and FloorDAO

Again clutching at straws. The NFTs are blue chip assets that are Lindy. No one is asking NFTx to take “illiquidity discounts” since we don’t need to get out of everything in 1 day. We don’t even know how many holders want to rage quit.

Plus this has been done before ad nauseam. L take - do better. Debunked

Can’t quite believe a bunch of token holders have to fight tooth and nail for their right to a backed token. It’s a gift of a situation, to have a capped downside token, and that was the primary reason for my purchasing it - yet the one redeeming feature of the project / token seems to be thoughtlessly removed. I get that this is a good deal for the team:

- get moon math pumpanomics

- Merit Circle helping out

- a sizeable call option on the new enterprise for free

- standard salaries

- higher odds of success

but it’s a bad deal for anyone w an NFTX token holding (no more downside protection and loss of backing and worse upside. Hope Gauss reads this and agrees.

Hey all would like to put forward two more ideas that I think would be amazing for NFTX and FLOOR holders

IDEA 1: No distro, launch new wind with same legal framework while retaining backing

- Instead of doing the merger into 1 entity, we do a merger into 2 entities.

- Entity 1: New Wind as described exactly in this proposal, but none of the treasury moves here

- Entity 2: Old Wind, this entity is a traditional DAO as we have now. 100% of both treasuries move into here.

- Old Wind deposits its assets into New Wind’s new product. In 6 months time it either merges or unwinds. If 50% of the FDV of new wind exceeds 1x treasury value it merges into New Wind and the assets move over. If it does not, it activates a rage quit for all holders.

- FLOOR and NFTX holders get airdropped both new wind and old wind tokens.

- The outcome is a separation of book value and enterprise value, with the exact legal framework the team wants, while maintaining book value in a DAO as is today.

- Everyone is happy - team gets the entire treasury as tvl to kickstart new wind, holders get the upside if it works, and are protected by a rage quit in 6 months if it fails.

IDEA 2: rage quit and launch new wind

- This whole time we’ve been saying its one or the other, but if new wind can’t succeed without the treasury then it would never succeed in the first place

- This idea is to put aside something like $1m from each project (floor and nftx) and invest them into new wind

- at the same time allow floor and nftx holders to rage quit

- result is holders get both, new wind and book value (wow!) and team gets $2m of funding which should be multiple years of runway to build together

I wanted to share a few thoughts here:

- I am quite pissed to observe that Merit Circle is the party pushing the hardest for this merger when they have all to win and 0 to lose in this. Merit Circle is very fast at telling current NFTX holders how they should behave with their governance tokens but quite slow at integrating the very good proposals made here to find a fair deal for everyone. Educating us about selling if we are not happy is not how you should engage in fruitful discussions with a community, and it isn’t because you bring a household name to the table that you should behave like everyone needs to bow to you and thank you.

NFTX has a substantial treasury, and this treasury belongs to the DAO holders, not to anyone else no matter how hard you try to fantasize about it.- All we are asking is for tokenholders who support this project not to get massively diluted, and to have a guarantee that the current backing, which has already decreased to finance the development of products that have not been generating any revenue, remains protected.

- I really don’t understand why all the good proposals to find a fair ground are ignored. If the goal is just to tank the vote and make sure everyone comes back here in 6 months to discuss a dissolution of the DAO, fine, but this shouldn’t be the goal here.

I was not surprised to see this proposal. We had FLOOR spin off from NFTX, run by many of the same core contributors; and today, both DAOs are holdings significant NFT/ETH liquidity and building complementary NFTfi protocols. So to me a merger makes sense. Focus the team on a single protocol and combine the treasuries to seed needed liquidity to the new protocol.

But then there’s the curve ball of bringing MC in as a major partner. Clearly the core contributors are excited about what they’re building and about what MC can bring to the table. However, the token holders are rightly concerned about overpaying for MC’s services.

So we have:

- A full (re?)combination of FloorDAO with NFTX

- A negotiation with MC to properly price their services

I support (1) out of hand. The teams, treasuries, and development goals are already overlapping.

With (2), the details are left somewhat vague, so I don’t know exactly what MC has already contributed, what they’re planning to contribute, or even what the planned protocol entirely looks like. I think the gut feeling from most of us so far has been that it seems like a good deal for MC. That was my feeling too.

MC has clearly proved their value to our core contributors, whose judgement I trust.

But we’re proposing paying them millions in treasury value and significant equity – all up front.

“Merit Circle brings a lot of expertise to the launch of Project New Wind, specifically in marketing, go-to market strategies, branding, tokenomics, offchain structuring and governance.”

“Merit Circle will have a supporting role only”Are we valuing our own contributions of talent and treasury enough? Have we considered all other potential partners? Is it necessary to give MC significant control of our existing treasuries in order to secure their partnership?

Forum is a bit quiet so just incase this goes to vote within the next few days, would like to repeat

We should be optimizing for the best outcome for floor and nftx

I am 100% confident that worst case 2-3x best case multiple x

Is better than worst case complete losses best case multiple x

This proposal as is does the latter. If we can ensure the backing stays, is not diluted, and is accessible if the plan fail, we get the former

Numbers were posted above by marx for nftx but there’s no numbers for floor

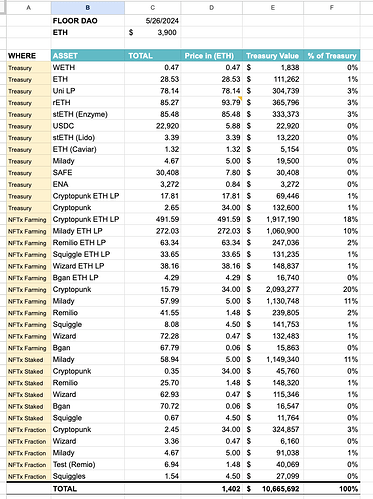

dcfintern did some calcs so everyone can have visibility there too

assuming 3.9k eth price, there’s ~$10.5M of non floor assets:

There’s 911k floorv2 in circ with ~200k owned by the treasury (LP and Treasury). Using a user owned supply of 700k you get $15/FLOOR

IDK if there will ever be a cutoff of migration from all the previous FLOOR tokens (aFloor, v1 floor, gFLOOR, etc.) but if we also assume 100% of that migrates the final FLOOR supply is worst case 1.04M… resulting in $10.25/FLOOR

FLOOR currently trades at $3.50 but was sub $3 when this proposal went up

So for floor holders there is a risk free 3-5x here… that we are fully sacrificing if this proposal passes, but we don’t have to. There have been many options shared where we can both try new wind, and if the outcome isn’t exclusively better than the backing, holders can claim the backing in 6 months or something.

Additionally, for FLOOR holders specifically, there was a rage quit in the past and those “floorkers” got $5/floor in the depths of the bear market. I don’t think it’d be great for the floor holders that stayed to not get the far larger treasury value they stayed for.

Even if its extremely unlikely new wind fails to deliver the results the team expects, we should prepare for the worst and ideally never need to call on those preparations.

Hi @0xchop - Thank for drafting the proposal and subsequent amendments.

I have one question at the moment, are Community tokens subject to vesting or are they unlocked right away at token launch?