This proposal suggests creating single-sided Sudoswap pools that trade against $FLOOR with the non-LPd NFTs in our treasury. The goal is to create a passive strategy for increasing demand for $FLOOR. In this way, $FLOOR obtained from NFT purchases through the pool doesn’t become a permanent hold. People can sell their NFTs back to the pool for $FLOOR, similar to a Sudoswap pool paired with ETH.

Why use $FLOOR in the pair rather than ETH? If our SudoSwap pool with $FLOOR as the quote asset is cheaper than other ETH-based listings, people will need to buy $FLOOR to get the NFT. This creates demand for $FLOOR while allowing NFT owners to sell back to the pool for $FLOOR later if desired. The result is buying pressure on $FLOOR when the paired NFT’s price rises, along with yield earned in $FLOOR during fluctuations.

This strategy also provides downside protection for $FLOOR. Since NFTs are paired with $FLOOR, a significant price drop for $FLOOR results in lower USD listing prices. This can make our SudoSwap pool listings appear below the floor on NFT aggregators. Traders will notice the discount and buy the NFT using $FLOOR.

In summary, the price movement of $FLOOR will be more closely tied to the NFT it is paired with. If an NFT’s value increases and the pool accumulates a significant amount of $FLOOR, but then the NFT’s value drops back to its original price, $FLOOR will be sold in the open market, causing its price to decrease. We will still however collect trading fees in $FLOOR, decreasing the $FLOOR circulating supply. Keep in mind, since the pool begins as single-sided with only NFTs as balance we are making a directional bet that the NFTs will increase in value. If the NFT goes below our starting price, nothing happens.

To clarify this concept, let’s use a practical example with Miladys.

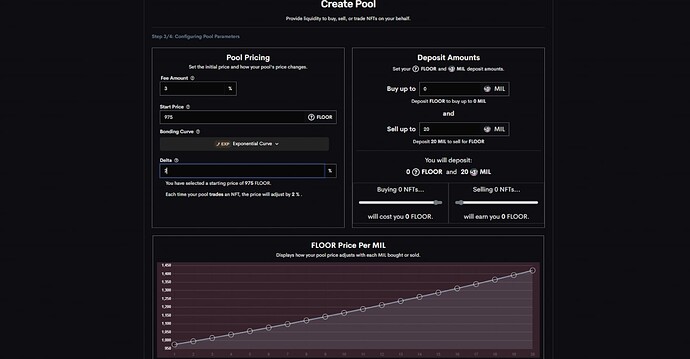

Imagine a SudoSwap pool with these settings:

- Pool type: Trading pool (Collect Fees)

- Depositing: MILADY, $FLOOR

- Starting Balances: 20 MILADY, 0 $FLOOR

- Starting Price: 975 $FLOOR (Current price of Miladys in USD)

- Delta Type: Exponential (Not crucial)

- Delta: 2%

What this means:

We’re not initially depositing $FLOOR into the pool (the pool starts with 20 Miladys and 0 $FLOOR). We are betting on Miladys increasing in value against $FLOOR. If the SudoSwap pool has a balance of 0 Miladies and the Miladys price goes down, nothing happens since the pool is one-sided (No $FLOOR to sell)

As Miladys price increases, the pool sells Miladys for $FLOOR. After each Milady sale, the Sudoswap pool price increases by 2%, with the final Milady sold at 1420.39 FLOOR. Regarding downside protection, our pool offers it when the value is below the starting price (975 FLOOR per Milady). If the Milady floor is equal to 975 FLOOR and $FLOOR’s value suddenly drops by 10%, our pool’s Milady listing would be 10% below the floor price, creating an attractive arbitrage opportunity for traders who find this on an aggregator.

Summary:

Implementing these strategies can create intriguing arbitrage opportunities that may generate significant returns in $FLOOR. It would be worthwhile to test this approach on a smaller scale to evaluate its effectiveness before expanding it. Currently, FloorDAO holds about 1 million USD worth of NFTs not in LP positions. I recommend creating a pool with the 27 Miladys (valued at 100k USD) in our treasury.

- Yes

- No

0 voters