Objective:

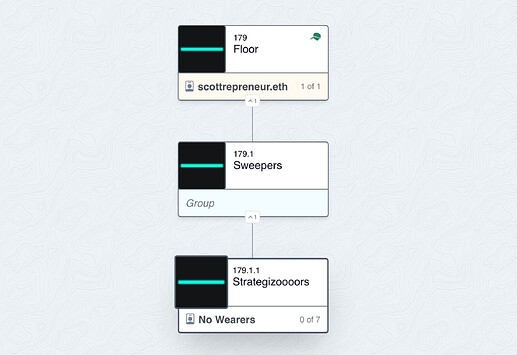

Create a Sub-DAO with a multi-sig to provide a structured seasonal capital allocation to NFT-Fi projects and other nascent strategies. This Sub-DAO will act as a council aimed to execute innovative NFT-Fi strategies and evaluate emerging projects without affecting the core V2 strategy contracts.

Summary:

I propose Floor forms a Sub-DAO funded with 110 ETH, managed by a multi-sig for executing and managing NFT-Fi strategies. This Sub-DAO is accountable to FloorDAO and will produce bi-weekly reports on strategy outcomes.

Seasonal Strategy Execution: Allocate a set amount of 25 ETH per quarter to NFT-Fi projects under specific themes (e.g., perps, options, lending) to assess yield generation. The first season will focus on perps/options, with future themes and projects decided by the Sub-DAO.

Reporting and Analysis: The Sub-DAO will provide regular updates and comprehensive seasonal analyses on project performances to inform integration into Floor’s treasury strategy.

Capital Management: Upon approval of this proposal, 110 ETH will be sent to a ⅔ multi-sig consisting of 3 addresses, managed by Nobi, Toes, and Caps, who will then jumpstart the NFT-Fi Seasons.

Funding Request & Compensation: 110 ETH will be sent to the new multi-sig, with 25 ETH being spent on NFT-Fi seasons quarterly and 1000 USDC being paid monthly to each signer as compensation.

Motivation:

This approach allows for the exploration of new NFT-Fi strategies and project evaluations while mitigating risks and adhering to Floor’s risk-averse philosophy.

This proposal introduces a structured, risk-mitigated framework for exploring NFT-Fi strategies and projects, aiming to enhance Floor’s NFT-Fi ecosystem engagement.

The proposal is open for discussion for 4 days before a Snapshot vote.