Astaria<> FloorDAO proposal

FIP#40

Summary:

Astaria is a novel NFT lending platform that is nearing a public launch.

Our aim with this proposal is two-fold.

i) Support DAOs and projects that have NFTs as part of their treasury portfolio with financing options. There is a growing need for the NFT ecosystem as the maturity of the NFT markets emerges.

ii) Provide and sustainable market to earn yield in the NFT lending market—more on how Astaria can help in the motivation section.

Astaria is currently in development and will launch in the coming months. FloorDAO can be one of the launch partners.

Astaria believes in creating a more attainable financing protocol for borrowers. The average APR for these loans is still astronomical compared to the ERC20 market - currently sitting between 25% to 55%. Astaria believes in creating a more attainable financing protocol. We aim to add a level of competition in the market to bring the rates to a more sustainable level; we do this through our 3-actor model.

The 3-actor model is a model that allows borrowers (1st actor) and lenders (2nd actor) to interact with each other through a smart contract. The 3rd actor writes the terms of loans, the strategist. Strategists earn a percentage of all fees paid to their vault. More information about the 3 AM can be found here.

The Ask:

Astaria is looking for a strategic partnership in which FloorDAO provides liquidity to the Astaria lending vaults. In addition, FloorDAO can act as a strategist in the Astria ecosystem, enabling it to provide terms for collections that the DAO sees as essential to partner with (e.g. Miladies, Art Block, etc.)

The benefit to FloorDAO is that it will earn yield from the strategies they write. In addition, the DAO can use their position as a strategist to offer new collections a liquidity market, giving FloorDAO an advantageous position.

Regarding numbers, it is difficult to pinpoint a specific number to request at this pre-launch stage. However, to size the market, there is roughly $2,000,000 of loan origination per day. Astria hopes to gain 30% of this market within the first three months of launch. Making our goal to obtain ±$660,000 of loan origination per day. We expect our other strategists to provide liquidity to vaults.

Since we are also a new protocol, with us needing a growth curve, we expect less liquidity at the start. The below schedule is a realistic breakdown of what we expect liquidity provision to look like.

Month 1: $100,000 starter liquidity

Month 2: $300,000 provisioned liquidity to be added to the vault should demand to necessitate the extra funding

Month 3: Use the data from months 1 and 2 to submit a longer-term proposal based on demand and returns.

All liquidity should be based in ETH. It is also worth noting that all funds used in the vaults will be owned and controlled by the FloorDAO vaults, over which you have control.

Motivation

The growth of the NFT space will be supported by practical DeFi applications that give users fair financing options.

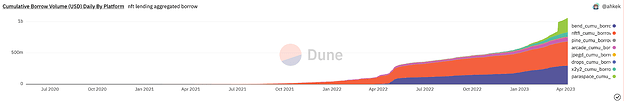

The average daily loan origination has grown from $300,000 to over $2,000,000 per day in the past few months. We have now crossed well over $1billion in loan origination. The market continues to grow, as seen from this Dune Dash.

We are also aware that the market is becoming competitive. Astaria’s benefit over the other protocols is to offer a more scalable solution where you, the strategist, are still in command.

Proposal benefits:

At launch, FloorDAO routes liquidity in Astaria vaults. The vaults work in a similar way to standard DeFi vaults. The size of the commitment is up to the community. FloorDAO still controls all funds in Astaria vaults.

FloorDAO proposes a set of collections for Astraia to support on an ongoing basis. Astaria and the community can create a proposal, voted for in governance, regarding which collections FloorDAO can add to its vaults.

The addition of new collections can serve as a reinforcement of current FloorDAO relationships. Giving current collections an extra bit of utility. It can also serve as a valuable add-on to FloorDAO’s offering to future collections looking to work with the DAO.

Thank you for your consideration. Questions, comments and suggestions are welcome.

Feel free to contact me directly if you want to discuss more.

Telegram: @chandlerdk

Email: chandler@astaria.xyz

More information about Astaria:

Specific information:

More general info:

Astaria Github