Summary

This proposal describes the development of the first FloorDAO-owned NFT-Fi product that aims to create sustainable yield for the DAO’s treasury and its Floor Wars.

To establish this new protocol and to maintain, improve and further decentralize the existing FloorDAO protocol, this proposal also includes the establishment and funding of Floor Labs - a dedicated research and development team for FloorDAO.

Motivation

Floor V2 has been successfully deployed on Ethereum mainnet with FloorDAO committing to fortnightly 15 ETH sweeps for the next 12 months. While Floor V2 has provided the DAO with critical infrastructure for the coordination and competition for liquidity via the FLOOR token, a new phase of growth is required to ensure that sizable ETH sweeps can be sustained (and grown) to increase participation and value.

An increase in the yield sent to the Floor Wars will further compound the DAO’s treasury growth and drive more competition for locking FLOOR in the Floor Wars.

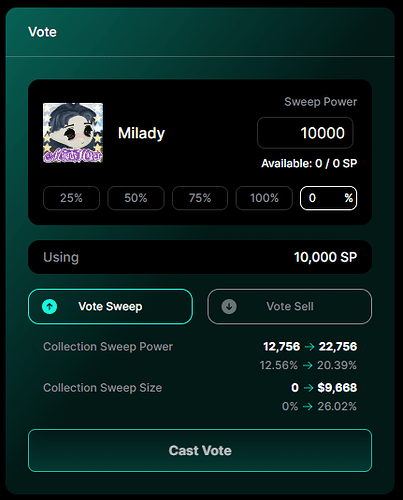

The above live example illustrates this; where 10,000 FLOOR (approximately $35,000) would provide the Milady collection with a $10,000 sweep every 2 weeks. If the Floor Wars were to reach sustainable fortnightly yield then communities and creators would stand to benefit significantly by supporting their collection through FLOOR governance.

In essence, FloorDAO and its FLOOR token are on a path to becoming the collection bootstrapping mechanism for creators and communities, leading to the NFT equivalent of Convex’s CRV wars.

For FloorDAO to sustain these 15 ETH sweeps (and beyond), a dedicated team needs to be well-capitalized and committed to executing a product roadmap that helps the DAO achieve this critical goal of becoming an invaluable liquidity coordination protocol. This roadmap begins with the development of FloorDAO’s own liquidity layer.

Introducing the Floor Layer for NFTs - Flayer

Flayer is a FloorDAO-owned fungible NFT liquidity protocol with a differentiated set of features that are unlike anything else available on the market. By owning the liquidity layer, FloorDAO is able to access its revenue streams and network effects from using the fractional Flayer ƒ tokens.

The primary objective of Flayer is to drive this revenue to FloorDAO and the Floor Wars. FloorDAO will control Flayer’s fee switch, revenue streams and (limited) onchain governance parameters.

Using a novel fee system, Flayer unlocks liquidity for not just floor items (as seen in most NFT liquidity protocols) but for mids and rares too, and these fees supplement Uniswap V4 LP positions to reduce the impact of impermanent loss whilst also tightening spreads for traders. Unlike Flooring Labs, liquidity for mids and rares is unconstrained with no requirement for a self-limiting reserve ratio.

At the base fungibility layer, Flayer has no fees or complex staking games, meaning 1 NFT = 1 ƒToken, allowing users and other DeFi protocols to freely move in and out of the fungible state of their token.

This opens the door for less complexity (lower gas, better UX), greater composability and an immutable and credibly neutral base layer to support a thriving ecosystem of NFT-Fi built on top.

Flayer’s differentiated features include:

- Liquid Listings: Instantly receive the floor value of your asset when you list your mids or rares and wait for the remaining value at point of sale. No reserve ratio on the number of items that can be deposited within a pool.

- Lockbox: Reserve items in the pool or protect your own items from being bought while accessing DeFi and liquidity. Reserve ratio to ensure enough floor liquidity remains available at any given time.

- Appraise: Arbitrageurs and collectors with specialized knowledge can re-list mispriced items directly in the pool and take the profit without the risk of ownership.

- Trade-Ups: Trade your floors for mids and rares.

- Zero Fee: Move between ƒTokens and NFTs without any protocol fees or token staking - a huge boon for composability and liquidity.

- Exogenous Fees: Liquidity providers don’t just earn AMM fees, they also earn from Liquid Listings, Appraisals and Lockboxes–natively in Uniswap V4.

There are also a number of second order effects from Flayer’s implementation:

- UV4 TWAMM/Limit Orders: Traders and collectors can dollar cost average into NFTs or set fractional limit orders, unlocking entirely new buying and selling strategies.

- Floor Pricing: Flayer listings are priced in multiples of the floor, allowing collectors and traders to peg their assets to the floor price of a collection.

- Cross-Collection Swaps: Uniswap V4’s singleton contract heavily reduces fees for routing through multiple pairs, making cross-collection swaps and trade-ups more viable.

- Liquidity Donations: Uniswap V4’s donate() method allows any collection or community to reward Flayer LPs with donations/bribes.

- Reduced Impermanent Loss: LPs are rewarded from non-swap activity on Flayer, meaning that the impact of impermanent loss as a percentage of overall yield is reduced.

- UV4 Hooks: Permissionless hook creation will continue to provide value to ƒ token holders as they can tap into newly developed hooks that improve the trading experience.

Uniswap have just announced that they expect Uniswap V4 to be released in Q3 2024, which lines up with Flayer’s planned roadmap. The timing of this opportunity is extremely favorable and due to our novel use of Uniswap V4, Floor Labs would aim to release Flayer as a UV4 launch partner.

flETH

The Flayer ecosystem will earn native yield for the DAO by deploying its own liquid staking token, flETH. Using the infrastructure from Geode.fi, flETH will have all of its yield “pivoted” to a separate smart contract that distributes to the Floor Wars and an insurance fund that protects flETH holders from unlikely node operator slashing events.

Liquidity providers on Flayer will pair ƒTokens with flETH (1:1 wrapped ETH) to earn the additional protocol yield from Liquid Listings, Appraisals and Lockbox fees while the ETH staking yield is collected separately by FloorDAO.

To interact with Flayer end-users will only need to use ETH. The cost of hopping between ƒPUNK/flETH and flETH/WETH is dramatically reduced in Uniswap V4 thanks to its singleton contract.

Let’s assume a 4% ETH staking yield on flETH circulating supply. After fees (Geode: 2%, node operators: 5%, insurance fund: 10%) the APR would be 3.32% and the following Floor War yield would be as follows:

Note it is possible for FloorDAO to remove the 5% node operator fee by running its own node operator in the future.

| TVL (flETH) | Annual yield (ETH) | Per Floor War (ETH) |

|---|---|---|

| 1500 | 49.8 | 1.91 |

| 5000 | 166 | 6.4 |

| 10000 | 332 | 12.8 |

| 50000 | 1660 | 64 |

| 100000 | 3320 | 128 |

flETH yield would be seeded by FloorDAO’s positions across liquid ETH, FLOOR/flETH and NFT liquidity positions such as ƒPUNK/flETH to give an initial seed TVL of ~1500 flETH.

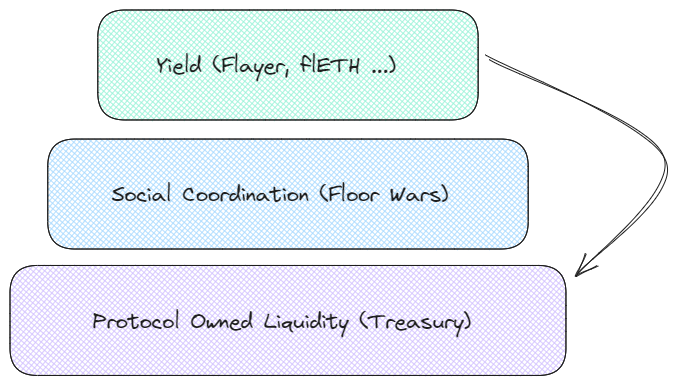

Conceptually, this breaks FloorDAO into three distinct layers. At its base, a Treasury. Above that is a social coordination layer (the Floor Wars) that establishes how the Treasury should be deployed. And from those deployments - yield - that is then compounded by being redeployed by the Treasury.

Introducing Floor Labs

Floor Labs is a research and development group that works on the Floor and Flayer protocols. It is proposed that the group is hired by FloorDAO to execute on the roadmap below.

Team

The team consists of experienced NFT-Fi and DeFi builders who have built the Floor and NFTX protocols:

- Twade: Protocol

- DYOR Ltd (Quag): Front-end*

- Joff: UI (Floor V2 designer)*

- Nobi: Community/Ops

- Caps: Product*

*denotes a new hire

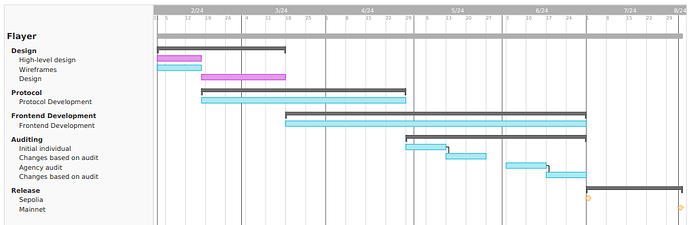

Roadmap

| Q2 2024 | Q3 2024 | Q4 2024 |

|---|---|---|

| Flayer testnet | Flayer mainnet | FloorDAO multi-sig removed and replaced with token holder governance |

| L2 launches |

Throughout development, Floor Labs will continue to support the ongoing Floor Wars and further develop the user experience and front-end treasury and yield data.

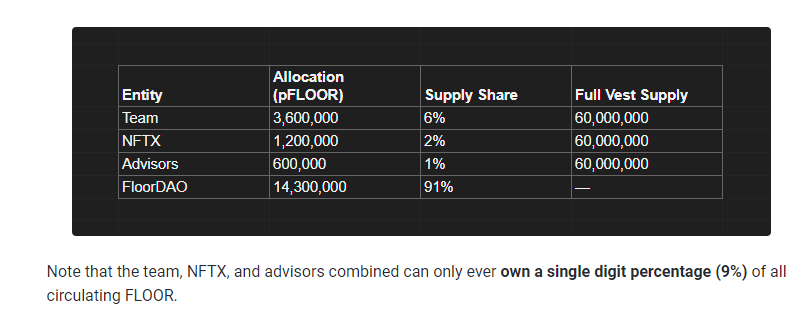

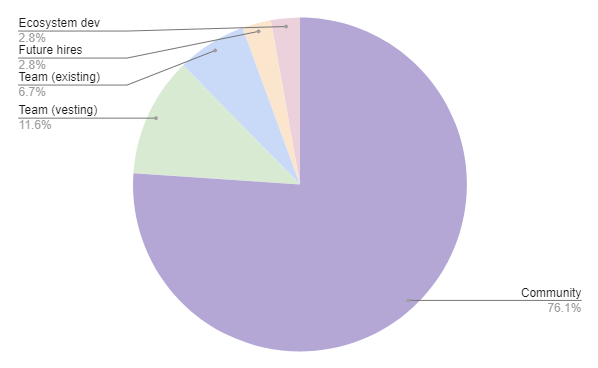

Updated Tokenomics

When Floor V1 was launched the team was allocated 6% of the total supply at a cost of 0.001 ETH per token. The current market value of FLOOR is 0.0013 ETH, which has severely weakened the impact of the initial vesting and resulted in misaligned incentives.

To address this issue it’s proposed that a new (conservative) vesting schedule is applied to the team, realigning long-term incentives and ensuring that Floor Labs makes strides in achieving the key mission of achieving high and sustainable yield for the Floor Wars and FLOOR voters.

Existing FLOOR supply: 1,084,972

New FLOOR mint: 235,000

New FLOOR supply: 1,319,972

Floor Labs internal allocation and vesting:

- Team: 135,000 (1 year cliff, 3 years linear)

- Future hires: 50,000 (1 year cliff, 3 years linear)

- Ecosystem development: 50,000 (4 years linear)

Combined with the existing FLOOR distribution (claimed and unclaimed vests) this brings the team to 18.3% of the proposed new supply.

Vesting would start at the time of Flayer mainnet deployment, providing existing holders with 1 year of market performance to consider their options.

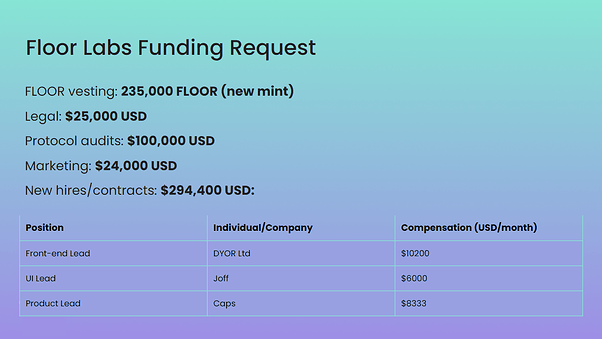

Proposal: Floor Labs Funding Request

Compensation guidelines from Olympus compensation process 3

Total funding request:

- 443,400 USDC

- 235,000 FLOOR

Timeline

The current iteration of Flayer (UI) is being funded privately to avoid delays in shipping ahead of Uniswap V4’s release. The following timeline has been estimated:

Poll

Yes — Approve proposal for Snapshot vote

No — Amend proposal (leave a comment)

The polling process begins now and will end at 10:30 UTC on 2024-02-23 (7 days).

After this, a Snapshot vote will begin shortly after the end of this poll.

- Yes - Approve proposal for Snapshot vote

- No - Amend proposal (leave a comment)