Summary

Recommend migrating the existing Floor DAO NFTX Punk position to NFTX V3 and creating 3 new concentrated liquidity positions and 1 staked inventory position. This will achieve the following:

- Maintain an ongoing pool on V3 similar to the current V2 pool

- Free up ~370ETH for Floor DAO to repurpose

- Earn ETH fees from V3 on any Punk trades

History

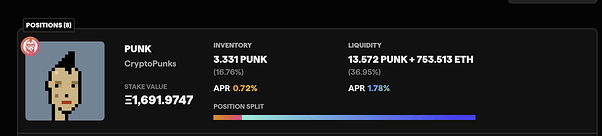

FloorDAO currently has approximately 1,691.97 ETH allocated to the PUNK position, with a breakdown of

- 13.5 PUNK paired with 753.513 ETH

- 3.331 PUNK staked in inventory

Previous proposals to sell off PUNK holdings to free up ETH for other strategies

- Sell PUNK Holdings & Fund a December Floor War

- FLOOR Treasury Diversification Proposal - #13 by yieldchad

NFTX V3 Concentrated Liquidity

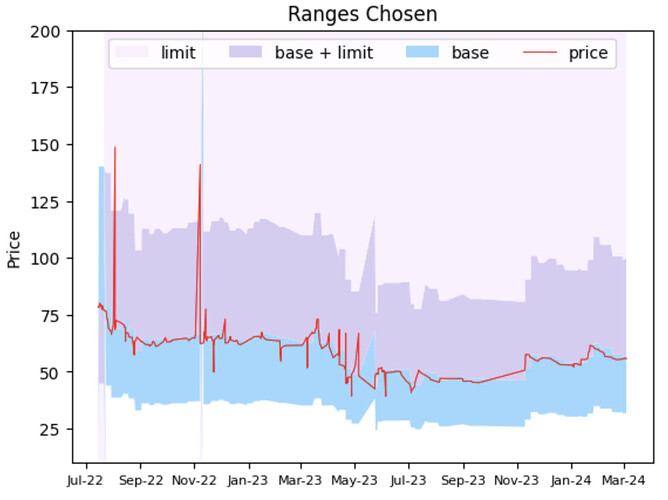

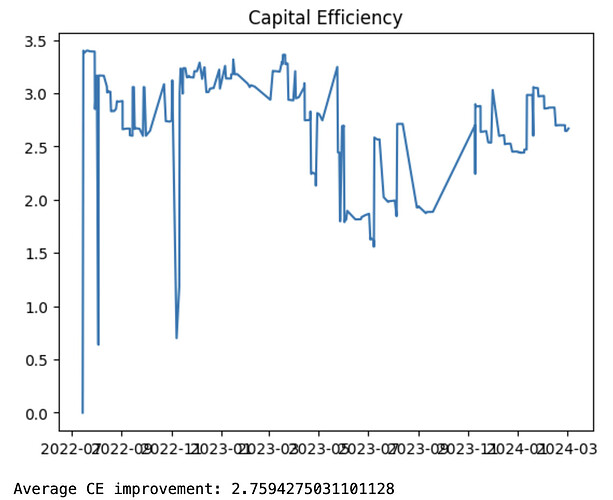

With the new version of NFTX you can now create concentrated liquidity positions allowing a better capital efficiency using existing liquidity provision. NFTX V3 is integrated into Reservoir already and will be shortly available in OpenSea Pro (with more integrations in the works). By changing the positions from supporting a price from 1wei to 20 quadrillion ETH (Uniswap V2) it now supports concentrated ranges of your choice (Uniswap V3).

NFTX V3 PUNK Vault

The new vault can be found here Buy, Sell, and Swap NFTs instantly on NFTX V3. NFTX has begun migrating their liquidity across to bootstrap the vault, currently 1 Punk has moved to inventory staking and a further 5 to Liquidity staking at two different ranges.

The fees are set to 1.5% for buys/sells/swaps, and this fee is paid out in ETH to the current liquidity providers based on how much of your liquidity was used in the trade.

Suggested Steps

- Migrate 100% of the current xToken staked to V3 Inventory staking(3 Punks)

- Migrate 100% of the existing V2 liquidity and unwind the SLP (approximately 13.5 PUNKS and 753.513 ETH)

- Sidenote: you can only migrate whole units, so it would be 13 PUNKS migrated across to start with and leave the other 0.5 in the SLP pool. NFTX will create a 1:1 V2-PUNK:V3-PUNK 0.01% Uniswap pool for swapping over existing tokens and arbing between protocols.

- Use the NFTX Migration Zap to bypass any fees and timelocks associated with having to stake inventory.

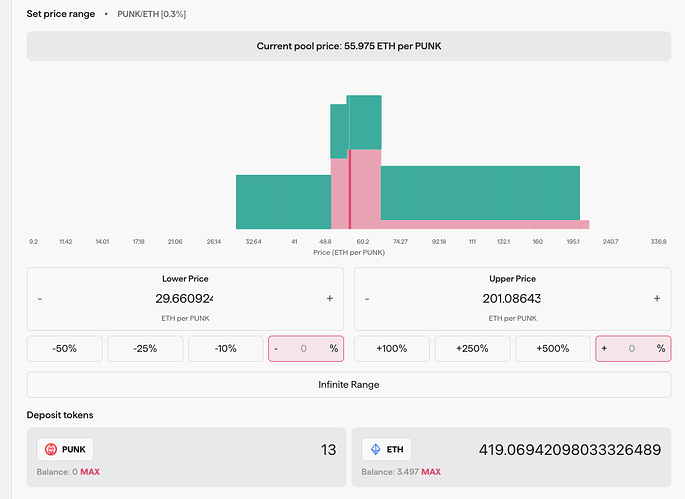

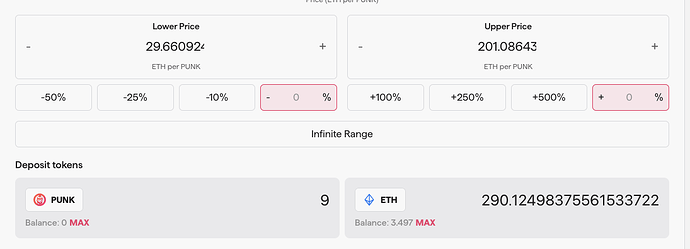

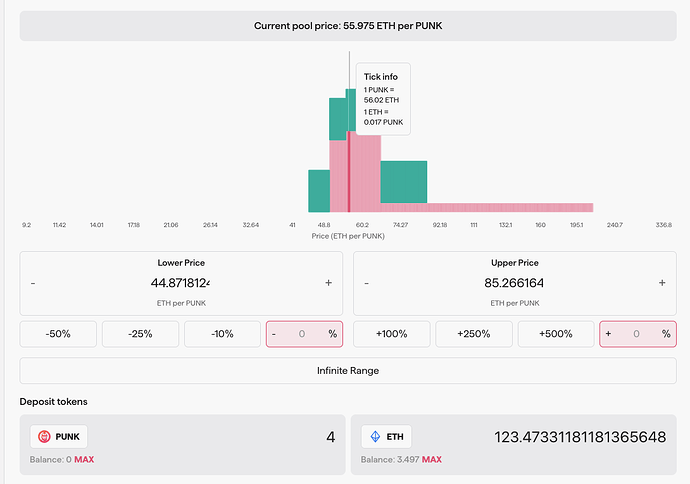

- Create 3 tier liquidity positions to maximise efficiency of ETH

| vToken | ETH | Lower Amount | Higher Amount | |

|---|---|---|---|---|

| Punk -25%<->60% | 6 | 221.5775628 | 41.75475815 | 88.92342579 |

| Punk -25%<->100% | 4 | 105.2557149 | 41.75475815 | 111.404173 |

| Punk -25%<->200% | 3 | 54.37255897 | 41.75475815 | 166.9583061 |

| Total | 13 | 381.2058367 |

Note: at these ranges if you drop below the 41ETH lower range FloorDAO will be holding all PUNK and no ETH. If they go above any of the “Higher Amount” ranges FloorDAO will be all ETH and no PUNK.

The approach frees up approximately 372 ETH from the current FloorDAO NFTX V2 PUNK position for application to other areas of NFT liquidity or NFT-Fi. This proposal will not cover the use of the spare ETH liquidity, but some options include:

- Create a ETH only PUNK position to DCA into punks during a pricing retrace

- Allocate this to ongoing new collection additions

- Allocate the funds to the 15ETH fortnightly sweep to increase the runway, almost another 6 months extra.

- Provide ETH to other De-Fi initiatives (for example the Gondi proposal)

This proposal is leaving the non-whole PUNK (v2) tokens as NFTXV2 position to allow any PUNK fraction holders to buy enough PUNK (v2) to make up a whole item, or to sell off their fraction.

Current Market

The current market for PUNK is always fluctuating therefore the below numbers will change over time, however this provides a general overview on the improvements that will be made.

| Marketplace | Buy | Sell | Difference | Floor Price | Floor difference |

|---|---|---|---|---|---|

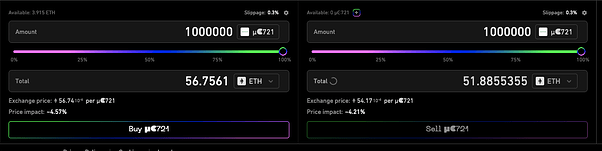

| PUNK/ETH | 57.6 | 54.37 | 5.77% | 56.5 | 1.93% |

| FP | 56.7561 | 51.88 | 8.98% | 56.5 | 0.45% |

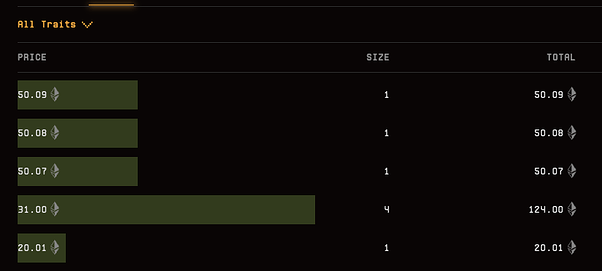

| BLUR | 57 | 50.09 | 12.91% | 56.5 | 0.88% |

The Flooring Protocol BID/Sell price is 51.88 ETH and the Blur bids are 50.09 with a depth of 3. The listing (buy) price is 56.7561 and 57.0 respectively.

The NFTX price would be 54.37 for a sell and 57.6 for a buy (including 1.5% vault fee paid in ETH and the 0.3% AMM fee). This places the NFTX V3 vault with the closest buy/sell spread and highest instant sale price (note that this is before NFTX migrate the remaining liquidity across from Sushi, so the price will improve and the difference will narrow further).

Potential Discussion Points

- Concentrated ranges — these can be changed, but with any changes there will be an impact on the amount of ETH required for pairing.

- Operational cost — aside from the personnel costs, it is estimated that migrating and creating the positions will cost approximately 1ETH.

- NFTX V3 security — the new protocol has gone through two audits and is running an Immunefi bug bounty program. NFTX has already migrated 6 punks and paired with 105ETH (TVL ~ 440ETH) into the protocol.

Out of scope

Although some potential uses were mentioned, anything related to the purpose/use of the freed up ETH are not related to this proposal.

Poll

Yes — Approve proposal for Snapshot vote

No — Amend proposal (leave a comment)

The polling process begins now and will end at 15:00 UTC on 2024-02-27 (7 days).

After this, a Snapshot vote will begin shortly after the end of this poll.

- Yes, Approve proposal for snapshot vote

- No, Ammend propoal (leave comment)