FloorDAO Rage Quit: Time To Move The DAO Forward

Summary:

This proposal aims to offer a rage quit option for token holders ahead of FloorDAO’s V2 launch in order to give V2 the best possible chance to succeed with unblocked governance and a passionate, aligned community while making good on investor promises made to holders since the founding of FloorDAO.

By passing this proposal every party can get what they want. The team still gets to build V2, holders that are excited about V2 can participate without non-aligned holders, and holders that want out of the DAO due to differences with V2’s direction get to leave with their fair share of the treasury as promised. Nobody is left worse off and it is exclusively beneficial for everyone in the ecosystem.

Bringing Market Cap (MC) equal to Treasury Value (TV) was a mechanism originally highlighted by the team as a ‘must have’ in V2 for the protocol to succeed and after months of failed efforts to bring MC in line with TV, and disagreements between the team and community over critical components of V2’s design, offering a rage quit option now would give unhappy token holders a chance to exit thus setting up V2 FloorDAO for a smoother launch.

Why Now Is The Time for Rage Quit:

It’s been 1 year since the FloorDAO team communicated their intentions with FloorDAO’s next big protocol upgrade through their V2 Litepaper, and within those 12 months, there’s been constant dialogue, discourse, disagreements, FIPs, proposals, and parameter reworks between the community and team.

As it stands now, V2 is still in the planning and implementation phase with the community and team disagreeing on major critical components like the vote-locking mechanism and how V2 improves FloorDAO’s growth in the market, and how value accrues to holders of the token.

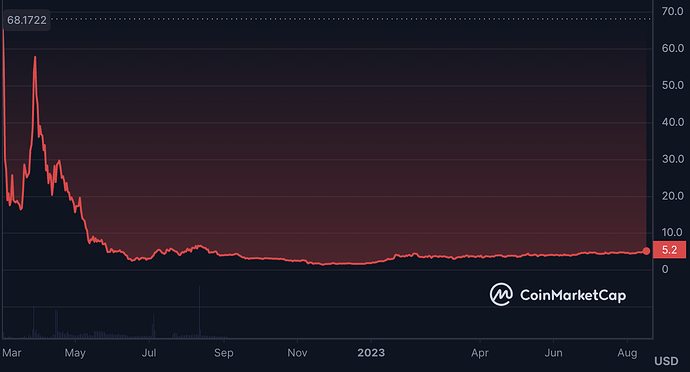

A lot has been riding on V2. It’s been touted by the team as a panacea to solving most of the problems affecting FloorDAO token holders including its falling share price (down 95% from ATH) and the lack of organic interest from NFT collections and their communities.

FloorDAO Is Struggling With Product Market Fit

Sadly, an NFT collection hasn’t been added to the DAO in over 6 months and only 1 of the 8 NFT collections added to FloorDAO has been actively participating in the protocol. This reflects a product-market fit issue and at the moment, it’s unclear how V2’s design helps bring product-market fit to the DAO.

Additionally, it’s been made abundantly clear by the Floor community that efforts and capital should be allocated to bringing Floor’s market cap in line with its treasury value. In 15 out of 16 gauge votes (Sweeps), the community has overwhelmingly voted to buy back the DAO’s token instead of sweeping more of an NFT collection. A strong signal that bringing MC=TV is a top priority for the community. Since MC still isn’t equal to TV at the moment, it’s clear that the current team-proposed solution of Gauge vote sweeps and the Charm pool is not sufficient to solve the problem.

This voting pattern of sweeping $FLOOR will likely continue over into V2 until the DAO’s market cap equals treasury value, meaning that under V2, 10E per week will go towards buying back $FLOOR instead of sweeping NFTs, putting V2’s success in a precarious place. This in turn hampers the DAO’s ability to execute its stated mission of becoming a valued and dominant NFTfi market-maker/liquidity provider thus becoming less attractive to NFT collections, further exasperating Floor’s product-market fit problem.

A rage quit before V2 would allow those who’ve been prioritizing $FLOOR buybacks to exit the community at fair value, thus making it possible for NFT communities to actively participate and win in Floor Sweeps and Collection Addition votes.

Promises of Backing are Wrongly Being Backtracked by the Team

Another core reason why the community should implement a rage quit mechanism relates to the team’s desire to remove the investor’s promise that the $FLOOR token is backed. When FloorDAO launched, its investor marketing material and protocol documents stated explicitly that “ If FLOOR is ever below the treasury asset backing value, then a theoretical arbitrage exists where FloorDAO can dissolve and distribute assets that are worth more than the market value of FLOOR”, expressing that $FLOOR holders are entitled to their pro-rata share of the DAO’s assets should the protocol shut down or redeem. In the last few months, the team has been trying to get rid of this key investor protection without a vote or going through due process. This is made clear by the DAO’s new publicly facing V2 docs that mention the token under the new protocol design isn’t backed. This is a serious attempt by the team to control and centralize the DAOs resources and makes every holder worse off. If the team wishes to remove backing, they should do the fair thing and let holders exit under the current investment terms under V1.

Governance is Blocked, Reducing the Effectiveness of the DAO

As it stands right now, FloorDAO is going through a governance struggle that will likely hamper V2’s ability to attract new community members and succeed in the NFTfi ecosystem. This governance block has created a hostile mood in Discord that detracts from the DAO’s mission and hampers collaboration between the team and the community. There have been multiple instances where the team’s vision for V2 and the DAO have been at odds with the community’s and there is consistently a disconnect between holders that want to see MC=TV and the team who has discounted that request. By allowing a rage quit before V2, FloorDAO community members who do not align with the current direction of V2 can exit at the token’s fair backing price, allowing the DAO to enter V2 with a dedicated and aligned community, arguably giving the DAO the best opportunity to govern and allocate capital more efficiently and effectively under the V2 roadmap.

Additionally, Marketing for V2 would be a wasted effort if new participants came into Discord to find it filled with FUD and disgruntled holders. New buyers could be unwilling to enter knowing that FloorDAO wouldn’t be able to effectively purchase or sweep their favorite NFT collection because of the focus on buying back $FLOOR. If Floor was to find product market fit, the token would be under significant sell pressure too at MC=TV, meaning it would be hard for the token to trade at a premium which could detract from new investors buying the token. By removing this sell pressure now, V2 will launch under the best conditions for success.

Rage Quit:

If the team truly wishes to remove token backing and implement long locking periods, FloorDAO should offer a rage quit option to community members who no longer align with the new direction of the DAO and want to exit at fair backing. Doing so would unblock community tensions and set V2 up for success upon launch.

Rage quit simply means that holders will be able to swap $FLOOR for their pro-rata share of the treasury.

Rage Quit Method:

FloorDAO holds a significant amount of its assets in NFTs, particularly CryptoPunks staked on NFTX. Currently, FloorDAO has 2.93 Punks in NFTX inventory and 22.732 PUNK + 1,084.901 ETH in the NFTX PUNK liquidity pool. This position is worth approximately $4,243,836. Given the size of the position, this will be the first position to be partially unwound to cover the cost of a rage quit.

Punks are a good option to fund a rage quit because they are actively traded on Blur and Opensea and from a yield generation perspective, they are Floor’s worst-performing asset. Partially liquidating the Punk positions by 50% would cover the cost of rage quit while leaving FloorDAO in a good position to earn a high APR yield from its most active pools like Milady and Remilio without damaging the DAO’s relationships with these high-value communities.

As a way to mitigate any unintended negative impacts on NFTX pools, NFTX will get the right of first refusal to purchase the FloorDAO Punks needed to cover the Rage Quit at a 3% discount to the average 14-day TWAP sales price on Blur calculated as of August 16th. That average TWAP sales price is 46.16 ETH per Punk. NFTX can purchase all the Punks FloorDAO wishes to sell or a partial amount. This allows NFTX to increase the amount of Protocol Owned Liquidity it controls, strengthening its pools while purchasing a grail NFT asset at a discount to market.

Rage Quit Cost Estimate:

The rough estimate of $FLOOR tokens that would want to exit the DAO is approximately 80,000-85,000 gFLOOR representing $1,900,474 to $2,022,236 of $FLOOR at $6.77/FLOOR. Meaning that approximately 13 Punks would need to be sold and 585 ETH pulled from the Punks LP position to accommodate the amount of $FLOOR that wished to redeem.

Selling Punks to NFTX or into Blur bids will come at a cost as we’ll likely be unable to sell the Punks at their floor price. This means that the backing value of the treasury will be reduced as will the redemption price of $FLOOR (likely by 2.5% or $0.17 per $FLOOR). New backing calculations will be determined and announced 1 week before the rage quit UI goes live.

If FloorDAO is unable to sell an adequate amount of Punks to cover the cost of the redemption, FloorDAO will explore allocating ETH from its other positions to make up the difference. This includes using ETH in the DAO’s stETH position or partially removing some ETH liquidity from the DAO’s other NFT positions or $FLOOR token liquidity pool.

Alternatively, the DAO can explore other funding methods like allocating its stETH position to the rage quit process as a way to sell fewer Punks, or it can evaluate selling other NFTs in its vault/inventory or unwinding and partially selling off some other high-value, low-yield NFT positions like Squiggles. This is up for discussion during the 7-day conversation period on the FloorDAO forum. If there’s no consensus on an alternative funding method then the plan to sell Punks will go forward.

The DAO will release a snapshot vote to signal how much $FLOOR wishes to redeem their tokens for treasury assets and liquidate the CryptoPunk position/allocate DAO-owned ETH accordingly.

Book Value Calculations:

Book value is calculated as Treasury Assets - Value of Protocol Owned $FLOOR / Circulating Supply of $FLOOR - Protocol-owned supply of $FLOOR.

- $9,476,742.86 / 1,561,523 - 162,120

- $9,476,742.86 / 1,399,403

- Backing = $6.77

- Less slippage/Cost of Punk Sales (est. $0.17/$FLOOR) = $6.60

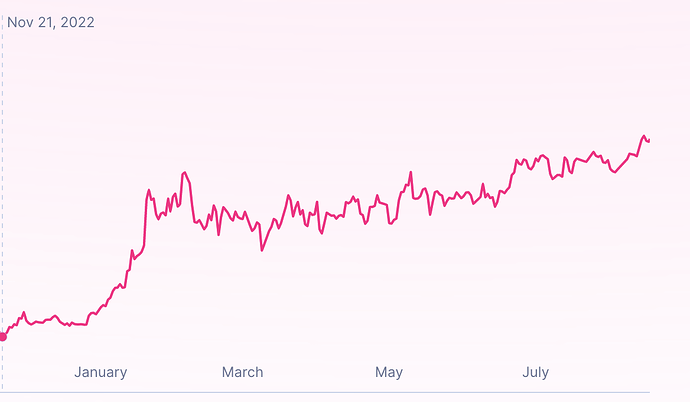

As of August 16th, the current Book Value for $FLOOR is $6.77, a 33% increase to the market price of $5.10 (number will change between now and rage quit). $6.60/$FLOOR represents a 30% premium to market price.

Backing calculations and treasury assets can be found here.

Rage Quit Process:

- This proposal will be posted to the FloorDAO forum for 7 days of discussion. Going on Snapshot Aug 23rd.

- During that 7-day discussion period, Twade can get started on evaluating rage quit/redemption contracts used by other DAOs and look to spec the front-end UI design that would allow for the token swap. Identifying a forked contract of a proven redemption contract should work.

- After 7 days of discussion on the FloorDAO forum, a rage quit Snapshot will be launched on FloorDAO’s Snapshot page asking $FLOOR holders to signal their interest in rage quitting the DAO - the snapshot will be up for 7 days.

- Snapshot Vote:

- Do you wish to participate in FloorDAO rage quit before V2 is live?

- Yes/Abstain/Amend

- Do you wish to participate in FloorDAO rage quit before V2 is live?

- Vote shall pass if yes votes equal or exceed amend votes

- In the event that amend wins, we’ll go back to a 7-day discussion period to fix the proposal and take into consideration community changes.

- If Rage Quit is approved, a Whitelist Snapshot will go live 24 hours after asking holders to whitelist their wallets for redemption - this will be up for 7 days.

- Twade will start work on implementing Raqe Quit contract and UI design.

- At the same time as step 3) FloorDAO will give NFTX 1 week to evaluate the right of first refusal offer. If NFTX doesn’t wish to purchase Punks, on the 7th day FloorDAO multisig will start removing 50% of the Punk position on NFTX. Sending the ETH to the multisig and commencing selling its Punks on the Blur NFT marketplace or Opensea (whatever has the highest bids).

- In total, 14 days is allotted to this step. 7 days for NFTX to decide on purchase, 7 days to sell Punks and allocate treasury to rage quit.

- At this point it’s been 5 weeks - After assets are sold and the rage quit contract and UI is in place, whitelisted $FLOOR holders will be given 30 days to swap their $FLOOR for treasury ETH. All unclaimed assets after that period would be returned to the DAO.

This proposal does not set a precedent when it comes to the expectations of a rage quit among the community. Its sole goal is to provide a path forward for the DAO and its holders as the protocol goes through a dramatic transition into V2. A non-passing vote does not mean $FLOOR is no longer backed in V1 or V2 nor does it restrict the DAO’s ability to execute another rage quit attempt in the future.

Thank you for reading this proposal, any and all comments, suggestions, and iterations are welcomed.

- Yes

- No

- Abstain