Background

This proposal aims to update the portfolio allocation of the FLOOR treasury to achieve the following goals:

- Allocate the treasury to new NFTfi strategies

- Obtain better yield for treasury assets

- Increase the diversification of treasury holdings

- Prepare the treasury for v2, for which a substantial amount of ETH will be needed

The suggested approach involves selling low-yielding positions and converting the proceeds into ETH, from which the ETH will be allocated to various strategies. Moreover, it is proposed that the 55 MILADY’s in the treasury be staked on NFTX to obtain yield. An initial allocation for 10% of the proceeds is detailed in the “Initial Portfolio Allocation” below. It is expected that depending on the results of the Sudoswap and SpiceFi allocations, future votes can be held to further allocate the remaining 90% of the liquidation proceeds.

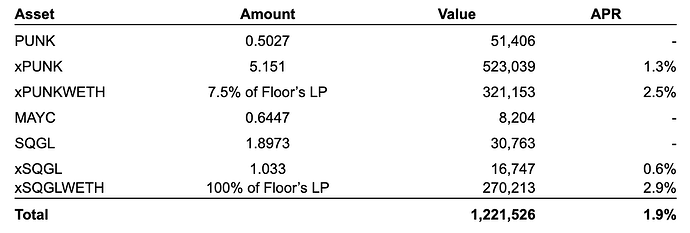

Please find below the list of assets proposed for liquidation, accompanied by their respective amounts, and estimated APRs. The asset values and APRs have been derived from

0x91e453f442d25523f42063e1695390e325076ca2 Profile | NFTX Yield 0xa9d93a5cca9c98512c8c56547866b1db09090326 Profile | NFTX Yield.

Initial Allocation of Proceeds from Liquidation

5% - Spice NFTfi strategy

- Spice Finance runs automated, and diversified yield-generating NFT-backed loan strategies across various NFT lending marketplaces. By depositing $WETH or $ETH, depositors gain exposure to a diversified set of loans, NFT collections, and LTVs with minimal gas costs due to transaction socialization

5% - NFTXv2 MILADY/ETH Pool

- It is proposed that a 5% of the proceeds from the liquidation be used to pair with existing MILADY’s to LP in NFTX’s MILADY/ETH pool

90% - stETH

- The treasury needs to prepare ETH liquidity for v2, during which 10ETH will be used to allocate to various NFT collections per week as voted by governance. This proposal aims to optimize the returns to the treasury by allocating to stETH, a highly liquid form of staked ETH, which will allow the treasury to earn a 5% yield as opposed to 0% yield for just plain ETH. stETH can simply be turned back to ETH when needed by the treasury.

SpiceFi

Spice Finance runs automated, and diversified yield-generating NFT-backed loan strategies across various NFT lending marketplaces. By depositing $WETH or $ETH, depositors gain exposure to a diversified set of loans, NFT collections, and LTVs with minimal gas costs due to transaction socialization.

Spice Vaults provide ETH borrow liquidity for loans against CryptoPunks, Azukis, BAYCs, and Miladys, among other collections. Read more here: NFT Collection Selection - Welcome to Spice Finance

As of 04/24/2023, the historical performance for their prologue vault stands at 17.37%. The team posts weekly performance updates in their discords and you can track Spice’s loan history on this dashboard: https://snowgenesis.com/profile/0x3e60C12997d3Bb062530e5F7e7f0400FBB9aEcA5?loanPanel=history&loanRoleType=lender

Resources to learn more about Spice:

https://www.spicefi.xyz/

https://docs.spicefi.xyz/

https://twitter.com/spice_finance

Audited by Zellic

Execution Plan

- Initiate the liquidation process for the specified positions in the same week. The PUNK and MAYC positions are expected to be relatively easy to liquidate, while the SQGL sales should be conducted more strategically, aiming to sell one every other day.

- Incrementally purchase stETH

- Deposit ETH into SpiceFi, coordinating with the SpiceFi team as necessary

- Allocate ETH and existing Milady’s to NFTXv2 MILADY/ETH Pool

- Ensure weekly updates on NFT sales and Spice/stETH allocations

- Yes

- No

- Abstain

0 voters